FinSystem uses modern technology and cannot ignore progress. The company believes that blockchain technology has great potential therefore, it is dedicated to exploring the use of this technology in the financial sector. Supporting blockchain technology will allow clients to enjoy the benefits that this technology offers. FinSystems issues its own token, Finsteco, which is based on the Ethereum blockchain and the Polygon network. Finsteco will serve as the foundation of the FinSystems ecosystem and its various services such as FinStudio, FinSocially, FinAlgo, FinQuant and FinData.

Token Sale

The FNST token sale will take place in 4 rounds with a total of 25% of the 1 billion tokens available for sale. The first round is a pre-sale to friends and personal contacts, followed by a private sale, a round for venture capital companies, and a public sale. The token will be listed on the exchange at the price of 10 cents per 1 token. The discount for each round will vary from 70% to 10% with the final round having the lowest discount. The allocation of tokens among the rounds will aim for an even distribution among different user groups and will have cliff and vesting periods to prevent price manipulation after listing on the exchange.

Token Allocation

In the FNST token allocation, 10% of the tokens are reserved for growth and possible collaborations with other projects. 15% of the tokens are kept by the FinSystems team, which will be distributed among individual team members and staff and locked for a long period of time. 5% of the tokens are allocated to advisors as a form of compensation for their help with the project. 10% of the tokens are kept as a reserve for miscellaneous expenses, which will be used gradually for additional expenses, operations, liquidity, rewards, etc. 15% of the tokens are reserved for staking rewards and 8% of the tokens are dedicated to liquidity. 12% of the tokens are reserved for incentive rewards, which will be given to those who help the project and members of the community.

Use of Funds Raised from Token Sale

The funds raised from the token sale will be invested in the project, with most of it allocated to technology and development, which is crucial for the success of the software company. Marketing is another important area that will receive a portion of the funds. Some of the funds will be used to replenish the liquidity pool and for liquidity, while the rest will be used for operations and legal services. The reserve will serve as a backup in case there is a need to invest more in any area.

Tokenomics

In tokenomics, the following elements are typically studied:

- Token distribution: How the tokens are distributed among stakeholders (e.g. growth, team, advisors, reserve, staking rewards, liquidity, incentive rewards).

- Token use cases: The purpose and utility of the token in the project's ecosystem.

- Token supply: Total token supply, whether it is fixed or inflationary, and if there are any mechanisms to reduce or increase the supply.

- Token inflation: Whether the token supply will increase over time, and if so, how much and for how long.

- Token locking: Whether tokens are locked for a certain period of time or subject to certain conditions, and what happens to the locked tokens.

- Token staking: Whether staking is available, and if so, the conditions, rewards and risks of staking.

- Token buyback and burn: Whether there is a mechanism in place to buy back tokens from the market and burn them, reducing the total supply.

A well-designed tokenomics helps to ensure the stability and sustainability of the project and the token, which in turn affects its value and market demand. Therefore, it is important to carefully consider and analyze the tokenomics of a crypto project before making an investment decision.

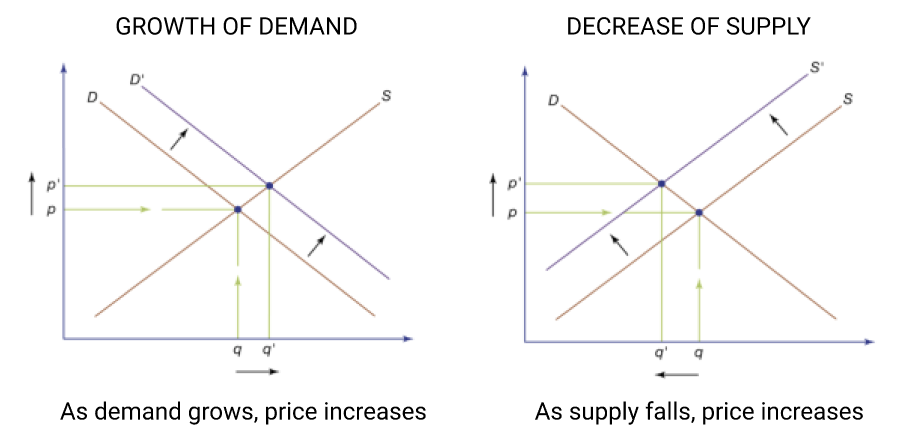

Factors affecting the value of tokens

The value of tokens in the cryptocurrency market is affected by various factors such as supply and inflation, interest rates, intervention, stability, economic performance, and tokenomics design. Tokenomics design includes the supply of tokens, allocation and distribution, main functions, factors influencing holding, and regulation mechanisms. The success of a token depends on the design of its tokenomics and the real use and benefits it offers to its holders. Investors should analyze the tokenomics of a token before investing to understand its potential for appreciation and utility value.

The main use of the token

The main use of the token in the project is to serve as:

- a means of raising funds for the project

- as a payment currency

- to enable smart contracts

- as a reward for incentivizing users who contribute to the project's growth

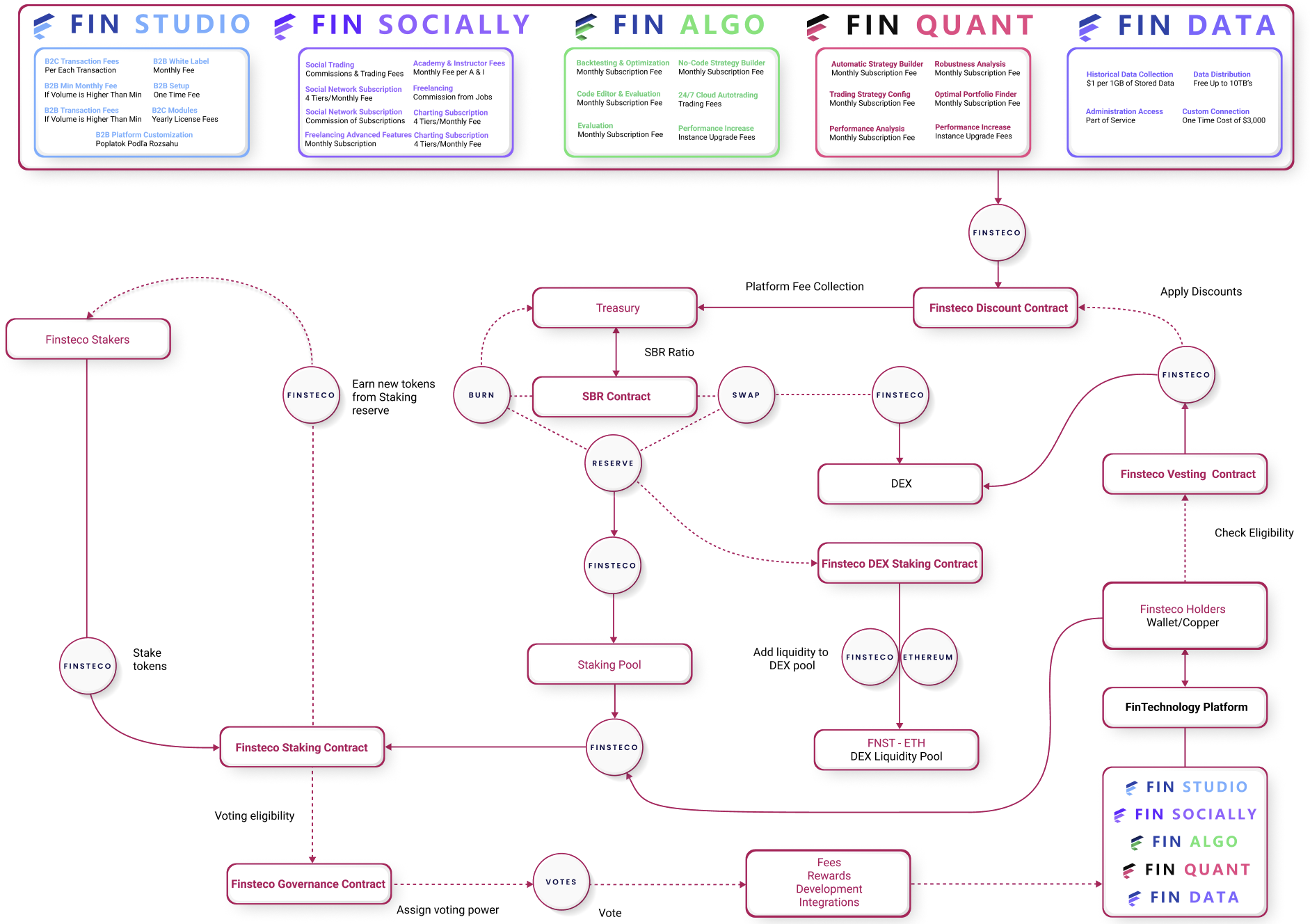

The token will be used to purchase products and services within the project's ecosystem and will have real value based on natural demand. The token will also contain several smart contracts, such as fee and discount, vesting, staking, governance, and SBR contracts, which will automate various processes. Additionally, users can earn tokens by promoting the project on social media or contributing to its growth in other ways.

The utility and benefits of holding purchased tokens

Holding purchased tokens offer various utilities and benefits to users, such as:

- Staking: where users receive a bonus for holding the token for a certain period of time.

- Liquidity mining: where token holders can become liquidity providers and add tokens to the liquidity pool to receive rewards.

- Rewards for holding: users receive discounts on fees for the project's services.

- Governance: token holders who stake receive voting rights and can participate in voting on selected aspects of the project.

By utilizing these benefits, users can increase the number of tokens they hold, receive passive income, and have a direct impact on the project's development.

Mechanisms

The cliff and vesting period in token distribution is a mechanism used to avoid a sudden collapse in token price by ensuring that early token buyers hold onto their tokens for a specified period of time. The cliff period is a time period during which tokens are locked and cannot be sold, followed by the vesting period during which tokens can be sold gradually. The SBR ratio, which stands for Swap, Burn and Reserve, regulates the tokenomics of the system. The tokens received as revenue are swapped for fiat, burned to reduce the token supply, or stored in the reserve pool. This helps control the supply side and regulate the number of tokens that get back into the market. The firm receives part of its revenue in fiat, allowing it to sacrifice some of its revenue to support the token's growth and demand. The more the company's revenue grows, the more demand for its token will grow, driving the token's price up.